Our Blog

-

IRS ramps up compliance enforcement against certain businesses

- July 26, 2024

- Posted by: Jen Gostovic

- Category: Tax, Tax Legislation

No CommentsThe Inflation Reduction Act provided the IRS with billions of dollars of additional funding to reduce the so-called “tax gap” between what taxpayers owe and what they actually pay. The tax agency has already launched numerous initiatives aimed at this goal, including several business-related compliance campaigns. Let’s take a closer look at three of the

-

Governor Signs Tax Bill to Correct MN Standard Deduction Amounts

- March 1, 2024

- Posted by: Jen Gostovic

- Category: Tax, Tax Legislation

This week on February 26, 2024, Governor Tim Walz signed HF 2757, which “adjusts” the 2023 standard deduction to the proper inflation adjusted amount, correcting a drafting error in legislation passed last year. Taxpayers do not need to act, as the Minnesota Department of Revenue has been using the correct amounts on its forms. There

-

Beneficial Ownership Information Reporting Begins Under the Corporate Transparency Act

- January 31, 2024

- Posted by: Peter Maddalena

- Category: Business Legislation, Business Management

Post Update 1/31/24 – We apologize for the need for an additional blog email today. The first email notification that was to reference this content yesterday was unintentionally linking to the news of the Cummings Keegan office move. Sometimes technology settings can surprise us! We appreciate your interest in receiving our continued updates. Starting January

-

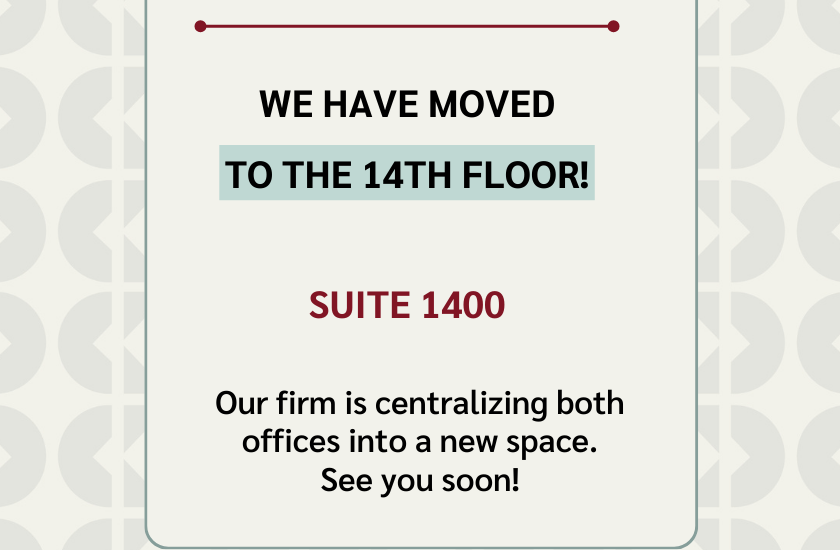

Exciting News! Cummings Keegan is Centralizing Offices into New Space and Unveiling a New Logo

- October 23, 2023

- Posted by: Peter Maddalena

- Category: CKCO News

Cummings Keegan announces with excitement its new address and new logo. The firm will operate from the same building in St. Louis Park on the 14th floor. The Apple Valley office will be closed on October 31, 2023. Email and phone remain the same. The news reflects a significant milestone in the firm’s journey.

-

SECURE 2.0 Act describe impacts to retirement planning; a must-read for employers and employees.

- February 15, 2023

- Posted by: Jen Gostovic

- Category: Tax, Tax Legislation

On December 23, 2022, Congress passed the Consolidated Appropriations Act of 2023. The sprawling year-end spending “omnibus” package includes two important new laws that could affect your financial planning: the Setting Every Community Up for Retirement Enhancement (SECURE) 2.0 Act (also known as SECURE 2.0) and the Conservation Easement Program Integrity Act. Bolstering retirement savings The original SECURE Act,

-

CHIPS Act poised to boost U.S. businesses

- August 5, 2022

- Posted by: Jen Gostovic

- Category: Tax, Tax Legislation

The Creating Helpful Incentives to Produce Semiconductors for America Act (CHIPS Act) was recently passed by Congress as part of the CHIPS and Science Act of 2022. President Biden is expected to sign it into law shortly. Among other things, the $52 billion package provides generous tax incentives to increase domestic production of semiconductors, also

-

Businesses: Act now to make the most out of bonus depreciation

- July 22, 2022

- Posted by: Jen Gostovic

- Category: Tax

The Tax Cuts and Jobs Act (TCJA) significantly boosted the potential value of bonus depreciation for taxpayers — but only for a limited duration. The amount of first-year depreciation available as a so-called bonus will begin to drop from 100% after 2022, and businesses should plan accordingly. Bonus depreciation in a nutshell Bonus depreciation has

-

Proposed regs for inherited IRAs bring unwelcome surprises

- June 14, 2022

- Posted by: Jen Gostovic

- Category: Tax

Back in late 2019, the first significant legislation addressing retirement savings since 2006 became law. The Setting Every Community Up for Retirement Enhancement (SECURE) Act has resulted in many changes to retirement and estate planning strategies, but it also raised some questions. The IRS has been left to fill the gaps, most recently with the

-

How inflation could affect your financial statements

- May 20, 2022

- Posted by: Kathy Klang

- Category: Audits, Business Management

Business owners and investors are understandably concerned about skyrocketing inflation. Over the last year, consumer prices have increased 8.3%, according to the latest data from the U.S. Bureau of Labor Statistics. The Consumer Price Index (CPI) covers the prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services

-

The IRS again eases Schedules K-2 and K-3 filing requirements for 2021

- March 2, 2022

- Posted by: Jen Gostovic

- Category: Tax, Tax Legislation

The IRS has announced additional relief for pass-through entities required to file two new tax forms — Schedules K-2 and K-3 — for the 2021 tax year. Certain domestic partnerships and S corporations won’t be required to file the schedules, which are intended to make it easier for partners and shareholders to find information related to “items

Contact us at the office nearest to you or submit an information request online.